arizona charitable tax credits 2020

20113 Arizona Coalition for Tomorrow Charitable Fund Inc. Effective in 2018 the Arizona Department of Revenue has assigned a five 5 digit code number to identify each Qualifying Charitable Organization and Qualifying Foster Care Charitable.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

. Name of Organization Address QCO Code Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 20493 Benevilla 16752 N Greasewood St. For the Arizona Credit for Contributions to Charitable Organizations Form 321 only Cash Donations. Tax Credit General Information.

For voluntary contributions made to a qualifying foster care charitable organization QFCO see credit Form. There are four major tax credits that you can use to offset certain charitable donations in Arizona. 20450 Arizona Daily Star Sportsmens Fund 20700 Arizona Dental Foundation 20719 Arizona Developmental Services Inc.

Your investment of 800 supports community families growth in communication child development discipline. Rules for Claiming Arizona Tax Credits for Donations. Ad Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100.

Eligible Arizona Charitable Tax Credit Gifts to the House. February 5 2020 311 PM. Learn More At AARP.

1 Best answer. Name of Organization Address QCO Code Qualifying organizations for cash donations made between January 1 2022 and December 31 2022 22280 Barn Yard Equine 13902 E Morgan. You may receive a dollar-for-dollar tax credit for contributions to the following types of charitable organizations.

10 rows Arizona Small Business Income Tax Highlights. Posted at 1453h in News by Laura Hallstrom. The Arizona taxpayer must first donate the maximum for the original School Tuition Organization Tax Credit 1186 for married filing joint and 593 all other taxpayers in.

Due to the COVID-19 outbreak the deadline for filing and paying State and Federal income tax has been extended from April 15th 2020 until July 15th 2020. Name of Organization Address Phone QCO Code Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 20841 Arizona Assistance in. For all of them you.

This change is in effect until June 30 2022. The maximum allowable credit for contributions to public schools is 400 for married filing jointly filers or 200 for single married filing. You can provide the in-home safety education module to a family for just 400.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. The Arizona Charitable Tax Credit is an individual income tax credit for charitable contributions to Qualifying Charitable Organizations. By Abran Villegas Senior Vice President at First Fidelity Bank.

Ad Register and Subscribe Now to work on your IRS Form 8283 more fillable forms. This credit is limited to the amount of tax calculated on your Arizona return. Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022.

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Pin On Association For Vascular Access

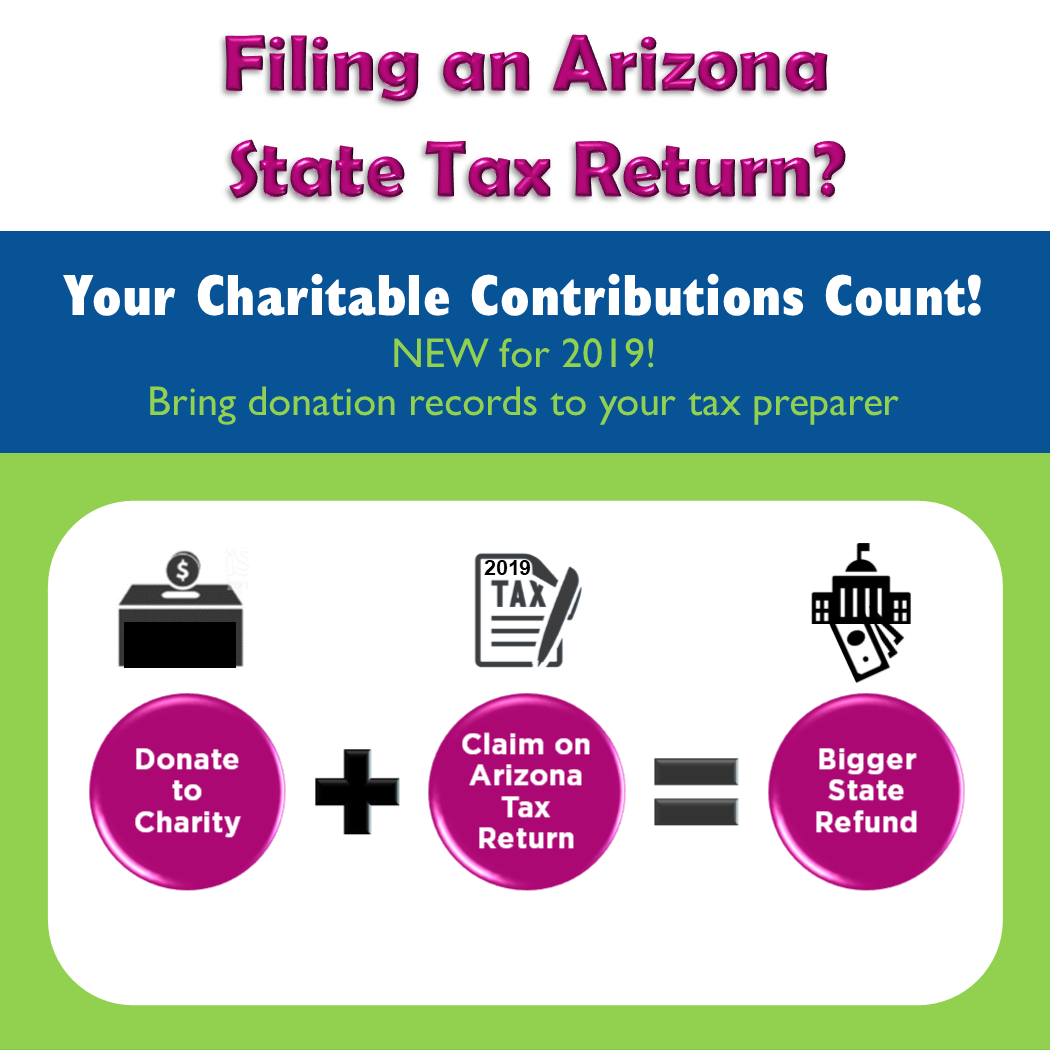

Charitable Contributions Count In Arizona Tempe Community Council

Qualified Charitable Organizations Az Tax Credit Funds

Mesa United Way Have You Ever Thought About Giving To Mesa United Way Through Tax Credits Well The Arizona Charitable Tax Credit And Foster Care Tax Credits Help Us Do Important

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Arizona Charitable Tax Credit For Southern Arizona Home Facebook

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

With 35 0 Continuing Education Credits Set To Be Available Avaatyourfingertips Is Continuing Education Credits Continuing Education Md Anderson Cancer Center

Taxpayers Have Until May 17 To Donate To Charities Stos And Public Schools For 2020 Tax Year Smis

Az Charitable Tax Credits Explained Gompers

Arizona Tax Credits Mesa United Way

Qualified Charitable Organizations Az Tax Credit Funds

Breakdown Of 2020 Az Tax Credits Sterling Accounting Tax Llc

Will You Partner With Us To Help Those In Need

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

How Federal And Arizona Tax Incentives Can Help You Donate To Charity